Testing your client’s integrity can keep you out of jail

In the context of recent events involving a Kimberley accounting firm in a significant National Lotteries Commission (NLC) fraud case, highlighted the need for accountants and bookkeepers to re-affirm their commitment to ethical conduct and robust and accurate record-keeping practices. The incident stresses the critical role that financial professionals play in maintaining the integrity of financial transactions and the disastrous consequences of neglecting these responsibilities.

The incident in Kimberley, where the Special Investigating Unit (SIU) and the Hawks conducted a raid to seize laptops and documents for evidence in the NLC fraud investigation, illustrates a breach of these ethical standards. Allegations suggest that some accounting firms and their representatives prepared and produced fraudulent financial statements for non-profit organisations (NPOs) and non-profit companies (NPCs) seeking grant funding from the NLC. This fraudulent activity undermines the accounting profession's ethical foundation and diverts crucial funds from community projects to uplift society.

Ethical behaviour for accountants

The Chartered Institute of Business Accountants (CIBA) requires all designation holders to comply with the IESBA (International Ethics Standards Board for Accountants) Code. The Code's fundamental principles—integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour—guide accountants to navigate ethical dilemmas and uphold their duty to the public interest. The Code emphasises the necessity for accountants and bookkeepers to ensure that their work adheres to the highest standards of professional ethics and to maintain meticulous records. Adherence to these principles is non-negotiable for maintaining public trust in accounting professionals. Considering the Kimberley firm's case, it is clear that any deviation from these principles can have far-reaching negative consequences.

Good record-keeping practices

The Code also emphasises the need for accountants and bookkeepers to maintain meticulous records and employ good record-keeping practices. Accurate, comprehensive, and timely records are the bedrock of financial accountability and transparency. They enable accountants to provide evidence of transactions and decisions, facilitate the audit process, ensure compliance with laws and regulations and also inform management decisions. In the NLC fraud investigation context, the lack of proper documentation, such as bank statements, was a significant red flag pointing towards fraudulent activities.

NLC funding and requirements for record-keeping

CIBA’s Business Accountants in Practice (BAP(SA)) members are mandated to perform the work of an accounting officer of a non-profit organisation (NPO) that receives funding from the NLC. These NPOs must adhere to rigorous standards for record-keeping and the preparation of annual financial statements in terms of the Nonprofit Organisations Act 71 of 1997. They must maintain accurate and detailed records of all transactions and financial activities associated with the grant. This includes, but is not limited to, invoices, receipts, bank statements, and ledgers documenting the allocation and expenditure of grant funds. Annual financial statements must be prepared in accordance with recognised accounting principles, which may include accounting policies applicable for the NPO or more formal accounting framework available for IRF4NPO. Financial statements contain a comprehensive overview of the organisation’s financial status, including income, expenses, assets, and liabilities related to the NLC grant. These documents play a critical role in ensuring accountability and transparency, facilitating audits and evaluations by the NLC to verify that funds are used appropriately and in alignment with the grant’s objectives. Failure to comply with these requirements can result in repercussions, including the possibility of revoking funding or future applications being denied. Therefore, NPOs must establish and maintain robust financial management practices to meet the NLC’s requirements and uphold the trust placed in them by both the funding body and their stakeholders.

Below is a handy checklist to follow when applying for a NLC grant, following the NLC Guidelines for Applicants.

How to avoid bad clients

Before accepting an engagement, an accountant must consider several factors related to the integrity of the client to ensure compliance with professional standards and ethics. The International Standards on Related Services 4410 Compilation Engagements and the Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants (IESBA) provide guidance on this matter. By considering these factors, an accountant can make an informed decision about accepting an engagement, ensuring that professional standards are upheld and reducing the risk of associating with clients that may compromise the accountant's integrity or professional standing. Here are the key considerations:

Integrity of the Client: Evaluate the integrity of the client's management and owners. This includes assessing their reputation for honesty and fairness in business practices. An accountant should be cautious if there are known issues related to the client's adherence to laws, regulations, or ethical standards in their operations.

Understanding the Client's Business: Gain a comprehensive understanding of the client's business, including its operations, industry, and the regulatory environment in which it operates. This understanding is crucial for assessing the risks associated with the engagement and the client's ability to adhere to applicable financial reporting and disclosure requirements.

Compliance with Laws and Regulations: Consider the client's history of compliance with laws and regulations, particularly those that have a direct impact on the financial statements. Any history of violations or non-compliance may indicate a risk to the accountant in accepting the engagement.

Financial Stability: Assess the financial stability of the client. Financial difficulties may pressure management to commit fraud or engage in aggressive accounting practices, which could complicate the engagement.

Management's Attitude towards Financial Reporting: Evaluate management's attitude towards financial reporting, including their approach to accounting policies and estimates, and their openness to suggestions made by accountants or auditors. A management team that is aggressive in its interpretation of accounting standards or reluctant to provide necessary information may pose a risk.

Previous Engagements and Accountant Changes: Inquire about the reasons for changes in accountants or auditors, if any. Frequent changes may indicate disagreements over accounting practices or other issues that could affect the accountant's decision to accept the engagement.

Communication with Predecessor Accountant: If applicable, communicate with the predecessor accountant to understand any professional or ethical issues that may influence the decision to accept the engagement.

Engagement Terms: Ensure that there is a clear understanding of the engagement terms, including the scope of work, responsibilities of the client, and the use of the accountant's report. This helps set clear expectations and responsibilities for both parties.

Independence and Objectivity: Assess the accountant's ability to maintain independence and objectivity throughout the engagement. Any relationships or circumstances that could potentially impair independence must be evaluated.

Accepting a client with questionable integrity poses significant risks for accountants, impacting their professional practice and reputation. Here's a more professional explanation with real-world examples:

Reputation Risk: Accountants rely heavily on their professional reputation. Accepting clients with a history of ethical or legal issues can tarnish an accountant's reputation by association. For example, if an accountant knowingly works with a company that has been involved in financial misreporting, the accountant's other clients and potential clients may question the accountant's judgment and integrity, leading to a loss of business.

Professional Risk: Accountants are bound by strict professional standards and codes of conduct. Engaging with clients who do not adhere to legal and ethical standards can result in the accountant facing disciplinary actions from regulatory bodies. This might include fines or suspension of professional licenses. For instance, if an accountant ignores irregularities in a client's financial records and it leads to tax evasion, the accountant could face penalties from professional accounting bodies.

Legal Risk: Legal repercussions are a significant concern. Should an accountant be complicit, whether actively or through negligence, in a client's illegal activities (like fraud or money laundering), they could face legal prosecution. This could result in legal fees, fines, or even imprisonment. An example would be an accountant who fails to report dubious transactions as required by law, later finding themselves implicated in a money laundering investigation.

Financial Risk: There's also a direct financial risk involved. Working with clients who lack integrity might lead to non-payment for services rendered, especially if the client faces financial scrutiny or legal challenges. Additionally, the costs associated with defending one's practice in legal or professional proceedings can be substantial.

Risk of Professional Liability: If an accountant misses or overlooks significant errors or fraudulent activities due to a client's misleading information, they could be held liable for professional negligence. This not only results in financial losses due to litigation but can also severely damage the accountant's professional standing. An accountant who fails to verify the accuracy of financial statements that are later found to contain material misstatements may face lawsuits from investors or creditors harmed by the misinformation.

Risk to Professional Relationships: Maintaining professional relationships is crucial in the accounting field. Associating with clients of dubious integrity can strain relationships with other clients, colleagues, and regulatory bodies, potentially leading to a loss of business and professional isolation. For example, if an accountant is known to work with clients who are frequently audited or investigated, other professionals may be less willing to refer clients or collaborate.

Operational Risks: Engaging with high-risk clients can lead to increased scrutiny from regulatory bodies, requiring additional time and resources to manage audits and investigations. This not only diverts resources from other areas of practice but also increases operational costs. An accountant working with a high-risk client may find themselves subject to more frequent and thorough audits by tax authorities, necessitating additional documentation and verification work that is time-consuming and costly.

You can find a checklist an accountant should complete in order to gain understanding of the client below.

In summary

For accountants and bookkeepers in South Africa, the Kimberley case is a stark reminder of the repercussions of ethical lapses and the importance of diligent record-keeping and avoiding bad clients. It is a call to action to comply with the IESBA Code and local regulations and champion ethical behaviour and transparency within the profession. By doing so, accountants and bookkeepers can help restore confidence in the NLC and the broader financial system, ensuring that funds intended for community development reach their rightful recipients without diversion or misuse.

CIBA template for documentation requirements for the NLC

The National Lotteries Commission (NLC) offers funding opportunities for various projects across different sectors. Specific requirements have been set forth for accounting officers and reviewers to ensure a streamlined and efficient application process for NLC funding. CIBA Accounting officers and reviewers are crucial in the NLC funding application process. Adhering to the outlined requirements ensures that applications are complete, compliant, and aligned with the NLC’s funding objectives. This working paper serves as a guide to assist accounting officers and reviewers in performing their duties effectively, thereby facilitating the allocation of funds to deserving projects and organisations.

Documentation Requirements

Organisational Documents:

Constitution, Trust Deed, or Articles and Memorandum of Association.

Proof of registration for non-profit organisations, public benefit trusts, and schools (excluding private schools). Tertiary institutions must cite the enabling Act.

Project Documentation:

Detailed Project Business Plan.

Detailed Project Budget, including specific line items with unit costs, quantities, and total cost per item.

Project Motivation.

For declared heritage site projects, a letter of support from the Municipality or Tribal Authority, or approval from the relevant provincial or national authority is required.

Financial Records (for a minimum period of 3 months):

Statement of Assets and Liabilities.

Statement of Income and Expenses.

Bank Statements.

Mandatory for Medium and Large Grants:

Most recent annual financial statements (one year for previously funded organisations, two years for new applicants), signed and dated by a registered and independent Accounting Officer or Auditor.

Signed Auditor’s or Accounting Officer’s Report.

Compliance and Review Process

Initial Compliance Check: Ensure that all required documents are present and correctly filled out. This includes checking the completeness of the application form and the alignment of the project proposal with NLC funding criteria.

Financial Review: Examine the provided financial documents for accuracy and consistency. This involves verifying the financial health of the organisation, the viability of the proposed budget, and the proper allocation of funds for the project's success.

Project Evaluation: Assess the project's feasibility, impact, and alignment with NLC objectives. This includes evaluating the project plan, budget, and motivation against the NLC’s funding priorities.

Documentation Verification: Confirm the authenticity and validity of all submitted documents. This may involve cross-checking registration certificates, deeds, and financial statements with relevant authorities.

Checklist for Understanding the Client's Business

Understanding the client's business is foundational to any accounting engagement. By thoroughly assessing the client’s industry, operations, financial condition, and risk environment, bookkeepers and accountants can tailor their approach to meet the client's specific needs, thereby enhancing the quality and relevance of their financial services.

Below is a handy checklist that can guide accountants and bookkeepers in ensuring a deep and comprehensive understanding of their clients' businesses during the planning phase of engagements.

OBJECTIVES

· To establish a comprehensive understanding of the client’s business and industry.

· To identify significant aspects of the business and its environment that could affect financial statements and reporting.

· To facilitate the design of an effective audit or review strategy that addresses the identified risks and areas of concern.

KEY CONSIDERATIONS

Industry, Regulatory, and External Factors:

· Industry Conditions: Understand the market conditions, competition, supply chain, and customer base that the client operates within.

· Regulatory Environment: Be aware of the regulatory framework governing the client's industry, including compliance requirements and potential changes in laws that could impact the business.

· Economic Conditions: Consider the economic environment affecting the industry and the client, such as economic cycles, interest rates, and inflation.

Business Operations and Processes:

· Nature of the Business: Gain insights into the client’s products or services, markets, and distribution channels.

· Operational Structure: Understand the organizational structure, key management personnel, and decision-making processes.

· Information Systems: Review the client's information systems for financial reporting and internal control processes.

Financial Performance and Position:

· Financial Analysis: Conduct a thorough analysis of the client's financial statements to assess financial health, performance trends, liquidity, solvency, and operational efficiency.

· Budgets and Forecasts: Review clients' budgets, forecasts, and business plans to understand their financial goals and strategies.

Risk Assessment:

· Business Risks: Identify risks that could affect the client's ability to achieve its objectives and impact financial reporting.

· Internal Controls: Assess the effectiveness of the client's internal controls in preventing and detecting errors or fraud.

Steps for Gaining Understanding

· Preliminary Meetings: Meet key management and operational staff to discuss the business model, strategies, challenges, and opportunities.

· Review of Documentation: Analyze recent financial statements, tax returns, budgets, business plans, and any available industry reports.

· Site Visits: If applicable, visit the client’s operational sites to gain a hands-on understanding of the business processes and controls.

· Industry Analysis: Research the client’s industry, including trends, risks, and benchmarks, to place the client’s business in context.

· Continuous Communication: Maintain an open line of communication with the client throughout the engagement to clarify any questions and obtain additional information as needed.

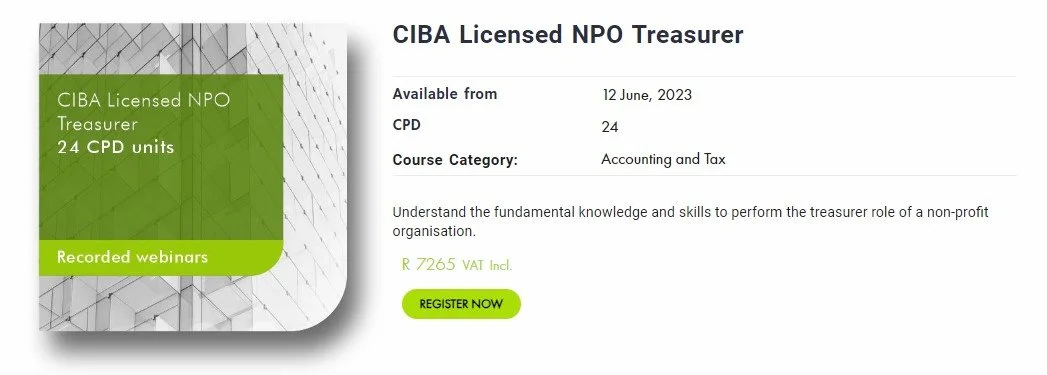

Boost your NPO's compliance and excellence with the CIBA Licensed NPO Treasurer Programme. In light of recent investigations, such as the SIU's probe into an accounting firm over lottery fraud, it's clear that about 50% of NPOs face deregistration risks due to filing issues and poor financial practices. Our programme offers crucial skills and training to improve accounting and reporting, tailored for treasurers of all NPO sizes. Partner with CIBA for better financial management, ensuring donor trust and a secure, prosperous future for your NPO. Learn more about enhancing financial oversight in the wake of the Special Investigation Unit's action. Read more here.