Profile: Chantal Misplon, Business Advisor

In our mission to build a strong accounting community in South Africa, Accounting Weekly highlights the journeys of accountants who make an impact in their field. This edition features Chantal Misplon, a business advisor at Digital Bookkeeping and Support Services (Pty) Ltd, recognised for her commitment to empowering small business owners and guiding them to financial literacy.

Chantal, a night owl, starts her mornings with a coffee while catching up on social media and emails, then plans her workday. Outside of work, she enjoys art, books, and a bit of Netflix, all while staying connected with friends and family.

Chantal Misplon

Business Advisor - Digital Bookkeeping and Support Services (Pty) Ltd

Past Experiences:

Business Accountant in Practice (SA) at DBSS (Pty) Ltd (Self-employed): Jun 2019 - Present (5 years, 6 months)

Financial Manager at Home Loan Guarantee Company: Feb 2012 - May 2019 (7 years, 4 months)

Financial and Management Accountant at Housing For HIV: Apr 2007 - Jan 2012 (4 years, 10 months)

Head Office Accountant at Caxton Community Newspapers: Apr 2003 - Apr 2007 (4 years, 1 month)

Senior Accountant at KPMG South Africa: May 1997 - Apr 2003 (6 years)

Qualifications:

Master Coach Diploma, Life and Business Coaching

Honours, Business Management

B Com, Financial Management

Country of Residence:

South Africa

LinkedIn Profile:

Connect with Chantal on LinkedIn

What time do you usually wake up on weekends?

9:00 AM

Are you an early bird or a night owl?

Night owl

How do you spend the first hour of your day?

I start with a cup of coffee while going through my social media and email notifications, then I plan my workday.

What sparked your interest in accounting or finance?

Many small business owners don't understand what 'the numbers' mean and often struggle with cash flow. I enjoy helping business owners with their financial and business strategy to avoid failure and maintain growth. Incorporating coaching helps them achieve business goals and become financially literate.

Can you share some key career milestones or defining moments?

The biggest issue for small businesses is cash flow. I've helped several small businesses turn their company around from a cash-flow crisis to a steady, profitable state.

How do you build strong relationships with your clients?

Communication is key. Clients like to be kept informed and to feel secure.

What are some future goals for your firm?

With good experience working with non-profits, I’d like to assist more organisations in maximising their funding. I also aim to transition from technical services to business advisory.

What’s next on your professional journey?

I plan to complete an Independent Reviewer license and a diploma in business coaching.

Share your strategies for maintaining balance between personal and professional life.

It’s essential to differentiate between 'work time' and 'personal time'. I keep my clients informed of my work hours, which are also displayed on my business page, to maintain boundaries. I make a habit of finishing work at an appropriate hour each day.

What do you enjoy outside of work?

An ice-cold beer with friends on a Friday is a great way to kick off the weekend. I also enjoy reading, listening to books, creating art, socialising, and a Netflix binge now and then.

Do you mentor or support other team members in the finance department?

I mentor young bookkeepers, helping them excel or even start their own businesses.

Are you involved in mentorship or local business initiatives?

I mentor and coach privately, empowering individuals with the skills they need to succeed.

What advice would you give to someone aspiring to start their own accounting practice?

First, save money to support yourself through the first year. Know your target clients and the services you’ll offer. Understand your worth, charge fair prices, and stay current with technology to incorporate it into your practice.

What’s your favorite quote or mantra that motivates you?

It is enough that I am of value to somebody today.

Share a leadership lesson or a piece of advice that’s been valuable to you in your career.

Leaders should have compassion and understanding, not just charm.

What’s something surprising about you that isn’t in your professional bio?

I used to be a fusion dancer and performed on stages in several cities across South Africa.

If you could have any superpower to help you in your job, what would it be?

A real magic wand!

What’s your go-to strategy for staying productive during long workdays?

I prepare by communicating with tax clients months ahead of deadlines and use templates to avoid redundancy. Quick breaks throughout the day keep my mind fresh, and focusing on the present helps me stay calm.

If you could relive one day from your career, which day would it be and why?

When I was promoted to financial manager, it felt overwhelming. But a year later, the CEO praised my work publicly. That recognition made me feel on top of the world.

Chantal’s story reflects her passion for empowering SMEs and fostering financial literacy. Connect with Chantal on LinkedIn to follow her journey and achievements.

Profile sponsored by the Chartered Institute for Business Accountants

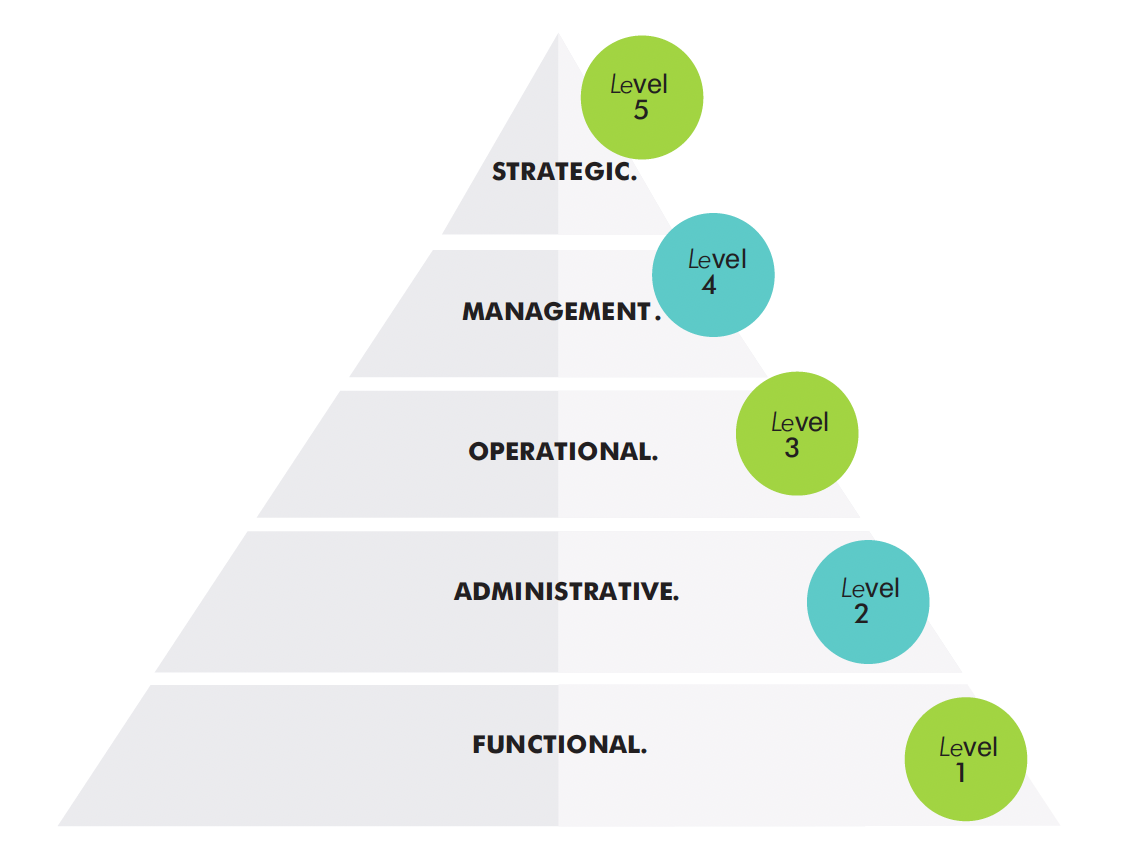

Not yet a professional designated accountant? CIBA is the professional body for all accountants. We offer designations for each stage of your finance career: BookkeeperFinancial AdministratorFinancial AccountantFinancial ManagerChief Financial OfficerAccountant-In-Practice.