The Tax Gatekeepers: Public Officers, Registered Representatives and Tax Practitioners

Who's Really in Charge of Your Tax Profile?

If you think your tax practitioner is handling everything, think again. When SARS comes knocking, it’s the public officer or registered representative who takes the heat, not the external tax pro. In this article we look at the high-stakes roles every company must fill (and often gets wrong).

Rethinking Taxation: Why Revenue Must Remain Conditional

Taxation is not an absolute right of the state but a conditional agreement between citizens and government. When taxes serve rights, transparency, and growth, they sustain prosperity. When they become an entitlement of power, they erode trust, freedom, and the very foundation of economic progress.

Home Office Tax Claims: What SARS Allows (And What It Doesn’t)

Think your dining table counts as a home office? SARS disagrees.

If you're working from home and hoping to claim tax deductions, you'd better know the rules. SARS's Interpretation Note 28 lays out exactly who qualifies, what counts as a home office, which expenses are allowed and what could land your claim in hot water. Read below and learn when and how to claim home office expenses and SARS scrutiny.

Medical Expenses in 2025: What You Can and Can’t Deduct

Need to claim medical expenses? This is for you.

With healthcare costs climbing faster than medical aid cover, understanding how to claim every cent of medical tax relief has never been more important. This article guides you on what medical expenses you can and can’t deduct in 2025, explains the difference between deductions and rebates, and shows how SARS’s medical tax credits can significantly reduce your tax bill. Read below and help your clients keep more money in their pockets while staying compliant.

SARS Expedited Tax-Debt Compromise Process: A One-Time Chance to Settle Tax Debt

Owing SARS money can feel like a never-ending burden, interest piles up, penalties grow, and enforcement looms. But for a limited time, taxpayers have a chance to hit reset. Through the SARS’s Expedited Tax-Debt Compromise Process, qualifying taxpayers may be able to settle their debt for less than the full amount, clear their tax record, and move forward with peace of mind.

5 Key Comments From CIBA on the 2025 Tax Amendment Bill

Big tax changes are on the horizon, and they could hit schools, side hustles, and retirees the hardest. CIBA has stepped in to raise concerns about the real-world impact of these proposals, warning that they could drive up school fees, punish entrepreneurs, schools, and retirees. What is CIBA’s goal? Keep tax fair, simple, and supportive of the people who keep the economy moving.

SARS Disputes Explained: From Objection to Court

Think SARS got it wrong? Here’s how to fight back legally and effectively. This article walks you through the full SARS dispute resolution process, from filing objections and appeals to navigating ADR, the Tax Board, and Tax Court. It's tailored for professionals who need to protect their clients (and their fees) when assessments go sideways.

The Tax Idea Pre-Mortem: Killing Bad Ideas Before SARS Does

A clever tax idea can save thousands today and cost millions tomorrow. The Tax Idea Pre-Mortem helps accountants separate smart tax planning from risky avoidance — with practical checks, real-life cases, and scripts to guide client conversations. Protect your clients. Protect yourself

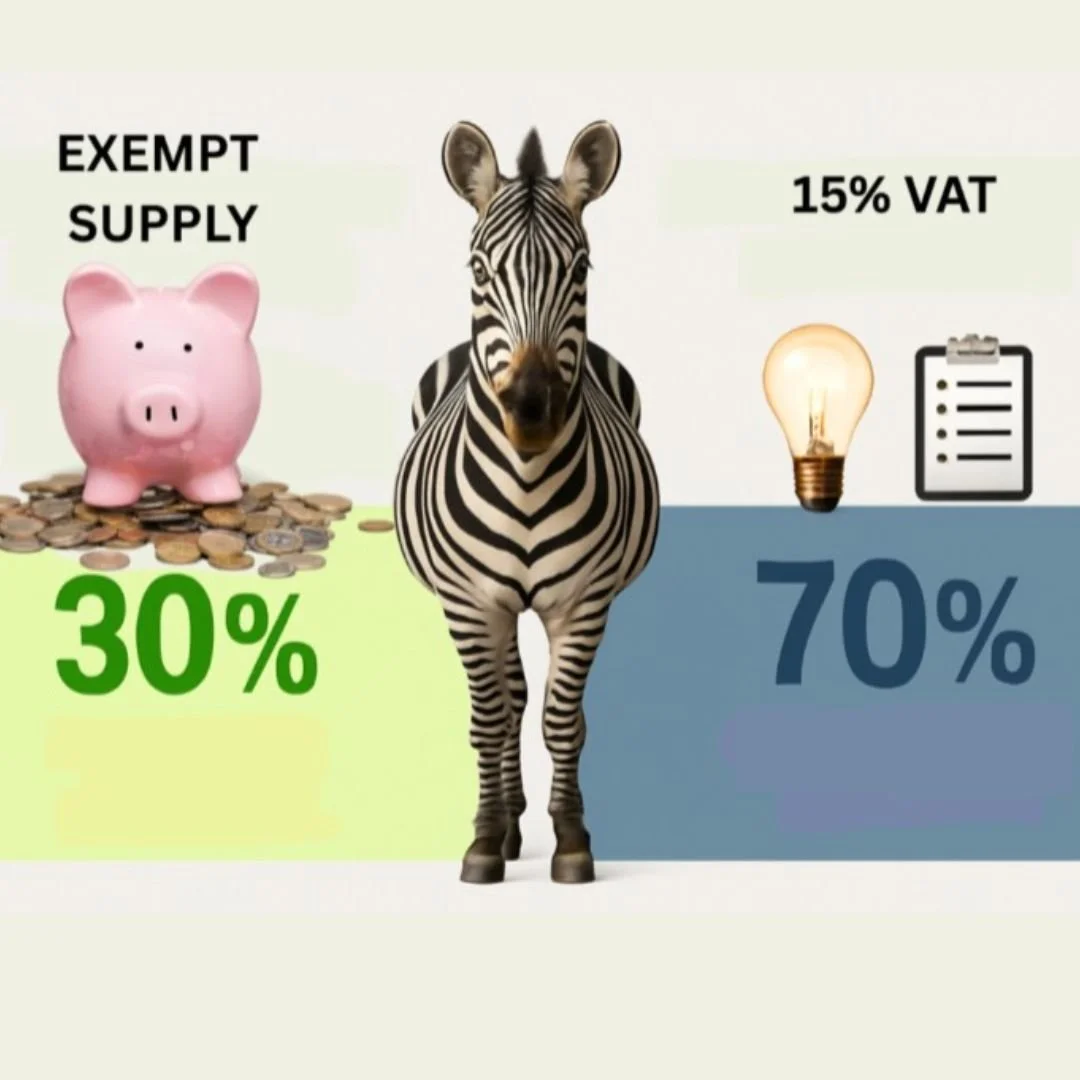

Mixed Up? Here’s What to Do When Your Business Has Both Vatable and Exempt Income

Think you’ve nailed your VAT strategy? Think again. From exempt supplies to mixed-income traps, recent court battles involving African Bank and Capitec show just how costly VAT missteps can be. In this article we look at exempt and vatable supplies, when you need to register for VAT, and what to do if your business earns both types of income. Get your VAT method right and save money and trouble with SARS!

Master Estate Administration with Confidence, Fast and the Right Way

Can business accountants help with a deceased estate? You need to tread carefully. The law says only certain professionals can legally administer an estate, and getting it wrong could cost you more than just your reputation. In this article we break down the must-know steps, deadlines, and legal limits every accountant needs to navigate estate administration safely and smartly. Don’t just offer advice, know exactly where the line is, and stand out by staying compliant.

Know Your Taxpayer Rights – And Use Them!

Think SARS holds all the power? Think again. You have a set of rights that protect you from overreach, delays, and unfair treatment, and they’re backed by the law. From getting the information you’re entitled to, to stopping drawn-out audits in their tracks, the Office of the Tax Ombud is your free, independent ally. This guide unpacks your 10 key rights, your responsibilities, and how to use them to save time, money, and stress.

Assessed Losses and Silver Lining in Your Business: The Tax Relief Done Right

Made a loss this year? Don’t sweat it! Assessed losses could be the silver lining that slashes next year’s tax bill. But there’s a catch: tax laws are changing, and SARS is tightening the screws on how, and when you can actually use those losses. Below we show you how to turn your loss into a smart tax move (and avoid losing out altogether…).

Fringe Benefits and Tax: What SARS Wants and How to Stay Out of Trouble

Think perks are just a nice-to-have? Think again. That company car, interest-free loan, or paid-for medical aid might feel like a bonus, until SARS comes knocking. Fringe benefits are firmly in the tax spotlight for 2025, and employers and employees alike need to understand how these hidden extras affect PAYE, compliance, and audit risk. This guide unpacks what SARS looks for, how to value common benefits, and how to avoid turning workplace perks into financial pitfalls.

Capital Gains Tax 101: What It Is and How Does It Work?

Think CGT is just for the ultra-wealthy? Think again.

Whether you’re flipping shares, selling a second home, or advising clients on big asset moves, Capital Gains Tax can creep up and bite, unless you know the rules. In this article we bread down what counts, who pays what, and how smart accountants turn tax traps into savings. Real examples, real numbers, and a few golden exemptions you don't want to miss.

Provisional Tax Status: Why You Should Check Twice a Year

Think you’re not a provisional taxpayer? Think again. Your tax status isn’t fixed and missing a change could land you with unexpected admin penalties. This article explains who qualifies, who doesn’t, what income counts, and how to avoid costly mistakes. Whether you’re an individual taxpayer or a practitioner, checking your status twice a year could save you from serious SARS trouble.

Auto‑Assessment or Auto‑Oops? What You Need to Know Before 7 July

This tax season, SARS is hitting “auto” on millions of returns, but that doesn’t mean practitioners can sit back. From 7 July, auto assessments will land in client inboxes, and while they promise speed and simplicity, they can just as easily conceal costly errors. If you're not reviewing every auto assessment with a fine-tooth comb, your clients, and your reputation, could be at risk. Here's what you need to know to stay ahead, protect your clients, and turn compliance into opportunity.

Freelancer? Commission Earner? Here’s How SARS Sees (and Taxes) You

Earning your own way through freelance gigs, commission deals, or contract work? Congrats, you’re your own boss. But SARS sees you as more than just independent; it sees you as a taxpayer with very specific obligations. This no-fluff guide breaks down what you need to know, from provisional tax to VAT traps, deductible expenses, and how to avoid getting misclassified (and penalised). If you’re making money outside of a 9-to-5, this is an essential read for you.

Wear and Tear and Recoupments - What You Can (and Can’t) Write Off

Think you know what you can claim for wear-and-tear? Think again. From small tools under R7,000 to second-hand vehicles and home-office equipment, SARS has clear. but often misunderstood, rules on what qualifies, how to calculate the deduction, and when you might have to pay it back. This article breaks down the essentials of Section 11(e), shows you how to use SARS’s write-off table, and explains the hidden risks of recoupments when assets are sold. Whether you're advising clients or managing your own tax affairs, this is a must-read.

The future of efiling and e@syFile: A commentary

Death, Taxes… and Auto-Assessment?

SARS is fast-tracking the future with AI-powered auto-assessments and bold moves toward a blockchain-based tax system. In this punchy commentary, we look at what this means for eFiling, e@syFile, and every taxpayer in between. Think smart contracts, digital tokens, and real-time VAT, all raising the question: are we ready for a tax revolution? Read the full article to see what’s coming, and how to stay ahead.

The Tax Ombud: A Watchdog for Systemic Failures in the Tax System

Ever feel like the tax system keeps tripping up? You’re not alone, and that’s where the Tax Ombud steps in. This article takes a closer look at how the OTO tackles systemic SARS issues that affect everyday taxpayers. If you're a tax practitioner or taxpayer who's spotted the same problems popping up again and again, here's how you can help be part of the fix.