Profile: Sanele Luthando Cebekhulu, Group Accountant

In our mission to highlight exceptional finance professionals, Accounting Weekly presents Sanele Luthando Cebekhulu, a dedicated Group Accountant with over six years of experience in accounting and finance. Sanele embodies a passion for numbers and financial storytelling, delivering insightful strategies and solutions in his role.

Sanele starts his day early, dedicating the first hour to planning and completing any pending tasks from the previous day or week. This disciplined approach ensures a productive and focused start to his day.

Sanele Luthando Cebekhulu

Group Accountant at ZIG Capital

Past Experience:

Group Accountant at ZIG Capital (Full-time): Aug 2024 – Present (5 months)

Financial Accountant at Thekvest Group (Contract): Apr 2024 – Jul 2024 (4 months)

Financial Accountant at Outsourced Finance (Full-time): Apr 2023 – Mar 2024 (1 year)

Accounts Payable Administrator at SPAR South Africa (Full-time): Oct 2021 – Mar 2023 (1 year 6 months)

Trainee Accountant at Austral Accounting (Contract): Mar 2018 – Sep 2021 (3 years 7 months)

Qualifications:

Bachelor of Technology in Taxation

Country of Residence:

South Africa

LinkedIn Profile:

Connect with Sanele

What time do you usually wake up on the weekend?

6:00 AM

Are you an early bird or a night owl?

Early Bird

How do you spend the first hour of your morning?

Planning my day and completing any pending tasks from the previous day/week.

What sparked your interest in accounting or finance?

My passion for accounting and finance stems from a fascination with how numbers tell a story. There’s beauty in transforming data into insights that help people make strategic decisions and achieve their financial goals. I love the structure and clarity that accounting brings, as well as the challenge of navigating complex tax regulations and ensuring compliance. Seeing how financial management can truly elevate a business, like a restaurant I manage the accounting for, has only deepened my commitment to this field.

Can you share some key career milestones or defining moments?

One of the earliest was becoming a Professional Accountant and Tax Practitioner, which opened doors to high-level responsibilities and set me on a path of continuous learning and growth. Joining a professional body in 2015 was a significant step, especially when I advanced from a student member to a full member.

Later, taking on the role of Group Accountant at Zig Capital allowed me to work at a strategic level, handling complex financial reporting and tax planning. Recently, I was accepted into the MPhil programme after passing the proposal module, marking a big academic achievement and a chance to further refine my expertise.

Also, my current involvement with Feduha Professional Accountants (my own accounting firm) has introduced me to the dynamic world of virtual accounting. Each of these moments has been crucial in shaping my path, sharpening my skills, and keeping me inspired.

What is your role within your company’s finance department?

In my role as Group Accountant at Zig Capital, I oversee a wide range of accounting functions that are essential to the financial health and strategic direction of our group. I handle financial reporting, and tax planning, and ensure compliance with regulatory standards. This involves analyzing data from multiple subsidiaries, providing insights on cash flow, and supporting management in making informed financial decisions.

I also work closely with our accounting team on software integration projects, like Xero and SimplePay, to streamline our processes. Ensuring accuracy and up-to-date records is a big part of my role, especially when preparing financial statements and tax submissions.

How do you contribute to the overall financial strategy of the business?

I contribute to our company’s financial strategy by providing actionable insights that guide decision-making at both operational and strategic levels. Through financial reporting and analysis, I help identify opportunities to improve cash flow, enhance profitability, and optimize expenses.

My work on tax planning and compliance ensures that we not only meet regulatory requirements but also take advantage of tax efficiencies where possible. Additionally, by implementing systems like Xero and SimplePay, I streamline our processes, which contributes to more accurate and timely financial data—critical for making proactive, strategic decisions.

Collaborating with management and advising on the financial implications of key projects or potential investments is also central to my role. This ensures that every major financial decision aligns with our long-term objectives, ultimately driving sustainable growth for the business.

What is one of the biggest challenges you’ve faced in your role? How did you overcome it?

One of the biggest challenges I’ve faced was managing the transition between accounting teams while preparing financial reports for group companies. Handling this required not only organizing extensive documentation and rectifying inconsistencies but also establishing new processes to ensure accurate and consistent reporting going forward.

To overcome this, I prioritized clear communication with both the previous and current teams, diving deep into each company’s financials to understand their unique processes and challenges. I implemented systematic checks and reconciliations, and I introduced cloud-based solutions like Xero to centralize and streamline our workflow. These steps helped create a smoother transition and allowed us to regain clarity and control over financial reporting.

What tools or strategies do you use to manage the financial operations of the company effectively?

To manage our financial operations effectively, I rely on a blend of software tools and strategic approaches. Xero is my go-to for bookkeeping, as it provides a clear, accessible platform for tracking expenses, revenue, and cash flow. For payroll, SimplePay is essential because it ensures compliance with tax regulations while automating payroll calculations and submissions, which saves time and reduces errors.

For reporting and analysis, I use Draftworx to compile financial statements and perform data analysis, which gives me a comprehensive view of the company’s financial health. In terms of strategies, I maintain a strong focus on cash flow management by forecasting cash inflows and outflows, which helps us anticipate any funding needs and avoid liquidity issues. I also establish regular financial reviews with key stakeholders to align our operations with the company’s strategic goals. Together, these tools and approaches keep us organised, compliant, and proactive in our financial decision-making.

Share your strategies for staying balanced, especially during busy periods.

To manage stress and stay balanced, I focus on exercise, gratitude journaling, and prioritizing rest. Solo coffee dates are a personal favourite on weekends, allowing me to centre myself.

Spending time with family and friends is also important for recharging, as well as exploring music and culture. Quick trips or hikes in nature help reset my perspective and keep me motivated.

Do you mentor or support other team members in the finance department? How do you help develop the skills of others?

Yes, I’m quite involved in mentoring within our team. I believe in fostering a collaborative environment where everyone feels supported and encouraged to grow. I offer guidance on complex tasks, like financial reporting and tax planning, by breaking down processes and walking team members through each step.

Whenever we adopt new software, such as Xero or SimplePay, I organize training sessions to ensure everyone understands not just how to use the tools, but also how they impact our broader financial goals.

I also encourage open discussions where team members can ask questions and share ideas, helping them build confidence in their decision-making. By providing constructive feedback and highlighting learning opportunities, I aim to empower others to take on more responsibility and develop their technical and strategic skills.

What advice would you give to someone aspiring to work in a finance department within a company? What skills or knowledge should they focus on?

Cultivate both technical and soft skills. On the technical side, a solid understanding of financial reporting, budgeting, and tax regulations is essential. Familiarity with accounting software like Xero, Draftworx, or any payroll systems like SimplePay can give you an edge, as digital proficiency is increasingly valuable.

However, the ability to interpret data for non-financial stakeholders is equally important. Developing communication and analytical skills helps your present insights in a way that influences strategic decisions.

Finally, stay open to learning and seek mentorship when possible—it’s a powerful way to deepen your knowledge and gain insight into the industry’s best practices.

What’s your favourite quote or mantra that motivates you?

"In the end, we remember not the words of our enemies, but the silence of our loved ones."

What’s something surprising about you that isn’t in your professional bio?

I love music and its connection to my family. It’s a grounding force and a reminder of resilience. Music has always been a way to unwind and reconnect with my roots, bringing a sense of peace outside of the structured world of finance.

If you could have any superpower to help you in your job, what would it be?

Predictive insight into financial trends! Being able to foresee shifts in the market, economic changes, or tax regulation updates would be invaluable for making proactive, strategic decisions.

What’s your go-to strategy for staying productive during long workdays?

Breaking tasks into manageable blocks and focusing on one priority at a time. Taking short breaks—whether for a quick walk, coffee, or even a few minutes of music—helps reset and maintain focus.

If you could relive one day from your career, which day would it be and why?

The day I was officially accepted into the MPhil programme. Passing the proposal module felt like such an achievement and a validation of the hard work I’d put in.

Sanele's commitment to accounting and finance is clear in the thoughtful insights shared throughout this profile. Connect with Sanele on LinkedIn to follow this inspiring journey.

Profile sponsored by the Chartered Institute for Business Accountants

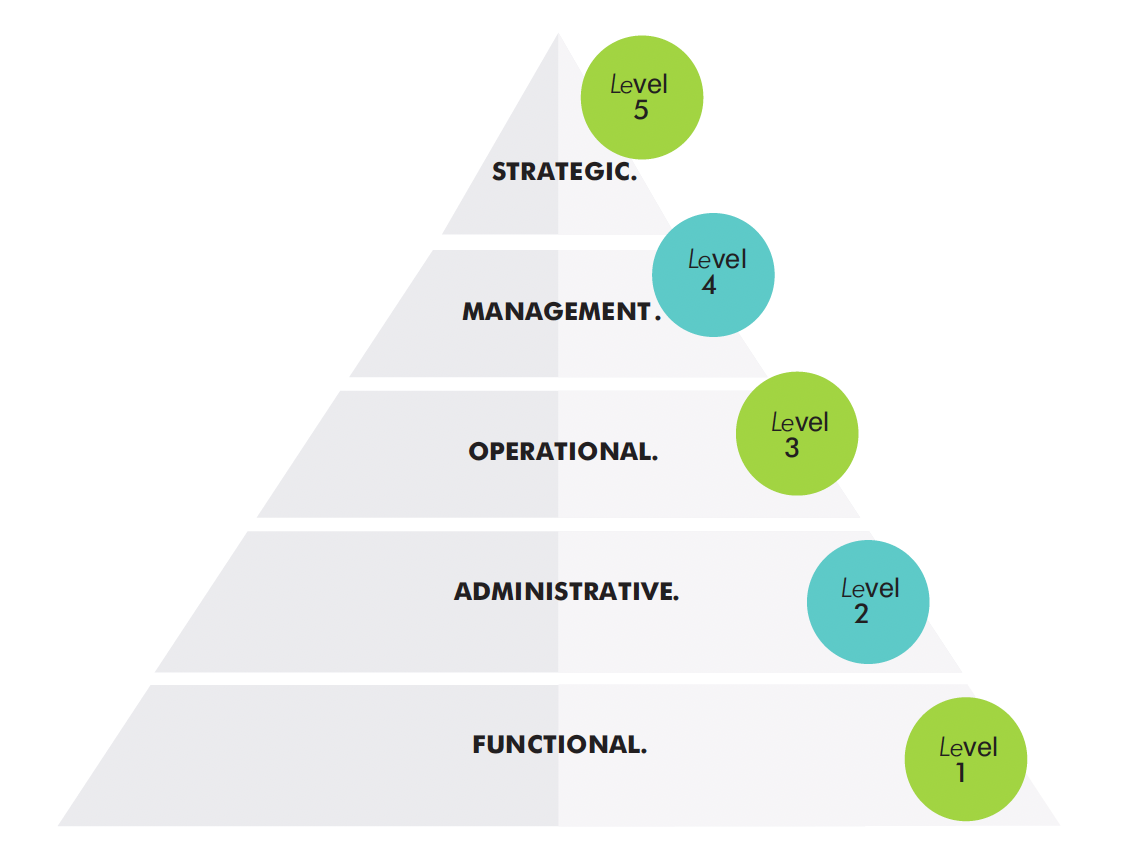

Not yet a professional designated accountant? CIBA is the professional body for all accountants. We offer designations for each stage of your finance career: BookkeeperFinancial AdministratorFinancial AccountantFinancial ManagerChief Financial OfficerAccountant-In-Practice.