New SARS Guide on Tax Compliance Requirements for Tax Practitioners

The Tax Administration Act 28 of 2011, alongside Interpretation Note 132, lays down the requirements for registration and ongoing compliance for tax practitioners in South Africa. It is crucial for practitioners to comply with these regulations to maintain their professional status and avoid severe penalties.

Registration Requirements

Under Section 240 of the Tax Administration Act, anyone who provides tax advice or assists in preparing tax returns must be registered with both a recognised controlling body and the South African Revenue Service (SARS) within specified timelines.

Note: Unregistered practitioners providing tax services for a fee illegally may face criminal charges, including fines or up to two years of imprisonment.

Compliance Obligations

Tax compliance is a cornerstone for both securing and retaining registration as a tax practitioner. According to Section 240(3)(d), compliance involves:

Registering for all relevant taxes.

Timely submission of tax returns.

Resolving any outstanding tax debts or arranging terms with SARS for their settlement.

Consequences of Non-Compliance

SARS has the authority to deny registration or deregister existing practitioners if they:

Remain non-compliant for a total of six months within the past year.

Do not address non-compliance or prove their compliance within a timeframe specified by SARS after receiving a notice.

Note: When SARS identifies the non-compliance of a tax practitioner, a notification sent directly to the practitioner's email, providing 21 business days to rectify their tax status. CIBA, as an RCB is not notified at this point. Keep in mind the following:

Keep your contact details with SARS up to date to ensure you will receive important notifications.

Should you receive such a notification from SARS, email to technical@myciba.org and we will assist you. See the steps SARS takes before deregistering tax practitioners in the Criteria for the Registration of Tax Practitioners and RCBs external guide.

Proactive Steps for Compliance

Maintain Continuous Compliance

Practitioners should avoid any non-compliance, as accumulated periods of non-compliance can lead to deregistration.

Respond to SARS Notices Immediately

It is crucial to engage with SARS quickly upon receiving any notices related to compliance. Ignoring these notices or failing to resolve the issues can lead to deregistration.

Keep Accurate Records

Good record-keeping aids practitioners in proving compliance during audits or reviews by SARS.

Encouraging Good Tax Practices to clients

In addition to achieving full tax compliance for themselves, tax practitioners are also expected to encourage proper tax practices among their clients. This includes advising them on the importance of accurate record-keeping, timely tax submissions, and fulfilling tax obligations. By guiding clients towards compliance, practitioners not only uphold their professional integrity but also support the effectiveness of the national tax system.

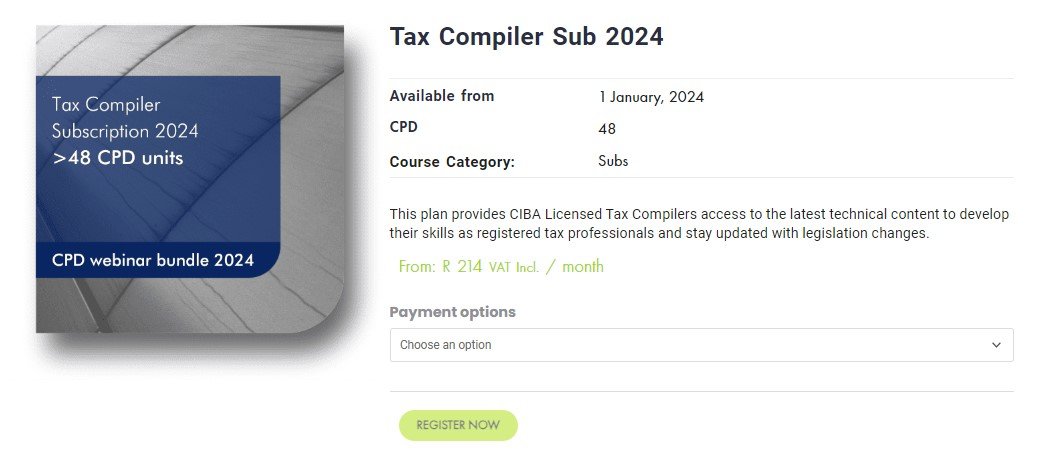

Keep up to date with CIBA’s Tax Compiler or Tax Advisor Subscription!

By subscribing to the Tax Compiler or Tax Advisor Subscription you will gain access to monthly webinars covering various topics; which will enable you to:

Be aware of the latest legislative changes and what it means for your business, practice, and your clients;

Prepare compliant taxation returns fast;

Issue reliable taxation calculations on financial statements;

Understand the laws and regulations that govern taxation; and

Perform tax compiler or tax advisory services.