SARS and Tax Practitioners: Survey reveals communication breakdown

Tax Practitioners have a low perception of SARS, according to a recent survey. Respondents point to a lack of quality communication as a core reason.

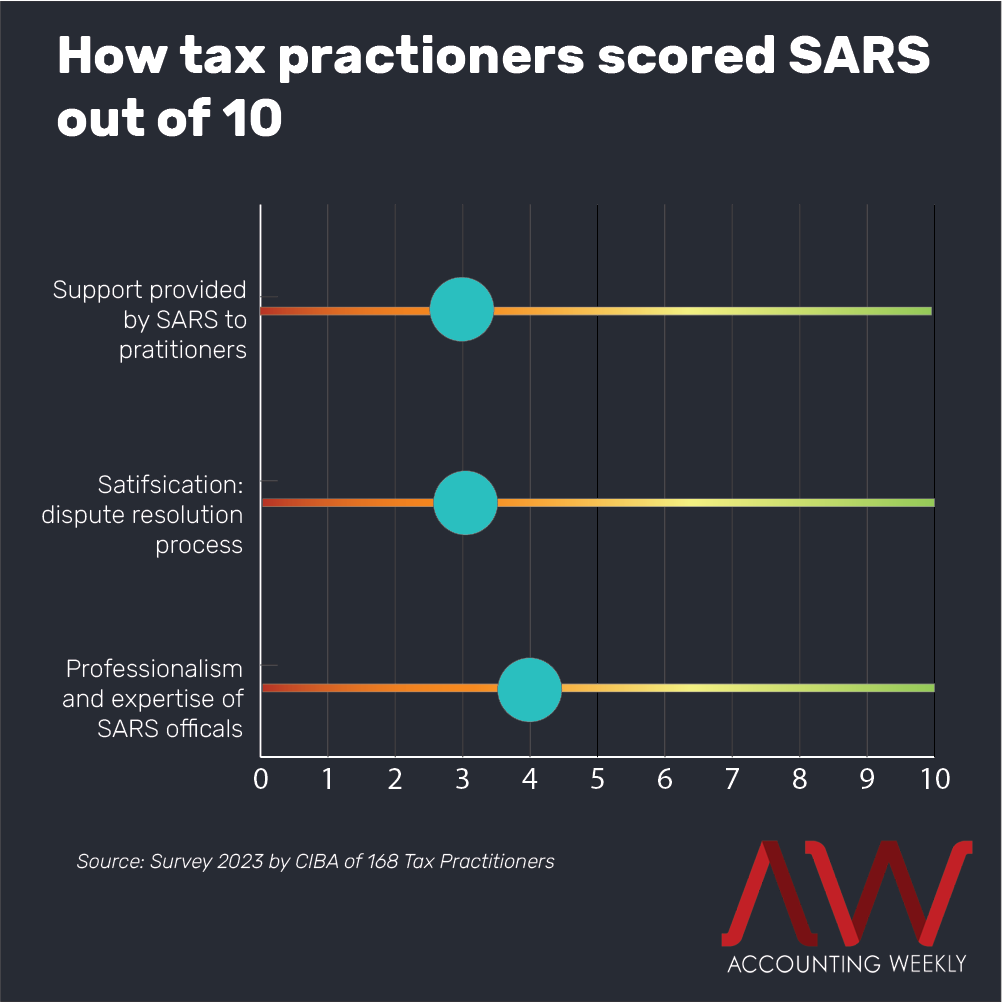

Three out of ten.

That’s the average score that tax practitioners gave SARS to questions about the overall level of support and assistance provided by SARS, and how satisfied practitioners are with SARS’ dispute resolution process.

The responses were part of a recent online survey of 168 tax practitioners. The practitioners are members of various recognised controlling bodies. Almost half have been tax practitioners for more than ten years.

In response, SARS spokesperson Anton Fisher says, “The SARS tax practitioner register is in the region of 25 000. If 168 of these have a negative experience with SARS, this must be seen in this context, though we firmly believe that one negative experience is one too many.”

Concerning the dispute resolution process results, Fisher says, “We are aware of the delays and challenges in the appeals process and later this month the electronic system supporting appeals will be enhanced which will allow the staff managing appeals to focus on the substance of the dispute and less time on the administrative requirements.

“In addition, as from 10 March 2023, the period to file an objection was extended from 30 days to 80 days which will provide taxpayers and practitioners more time to prepare their dispute papers.”

The survey noted other areas of concern. Eighty percent of practitioners indicated they encountered issues or challenges when dealing with SARS very often or extremely often.

The survey included a written response section, which asked practitioners for suggestions on what SARS could do to improve their support and assistance of tax practitioners.

Frequent suggestions include improving communication between SARS and tax practitioners and providing practitioners with better access to expert SARS officials.

Eighteen of the 152 written responses (not all participants answered all questions) suggested a dedicated communication channel for tax practitioners as a potential solution.

“I believe there should be a dedicated department allocated to tax practitioners. This will assist not just tax practitioners, but SARS to deal more swiftly with cases and most probably get cash in quicker.” wrote one respondent.

Fisher says, “SARS does have a dedicated voice channel for practitioners and practitioners can make appointments for branch visits via a dedicated eBooking queue to speak to suitably qualified SARS agents.”

“We are also in the process of enhancing the eBooking solution for this year’s filing season which will address some of the concerns previously raised by practitioners,” says Fisher. “For example the uploading of supporting documents at the point of making an appointment.”

A few respondents suggested SARS' drive towards automation was affecting the quality of communication. “SARS should consider the impact of their automated and often incorrect correspondence has on the relationship between taxpayer and tax practitioner,” wrote one respondent.

Some respondents report that SARS treats them antagonistically, “Please don’t see us as the bad guys,” suggested one practitioner. “Treat us as an asset in their efforts to make taxpayers compliant and not as the enemy,” wrote another.

Fisher says, “In terms of another of SARS’ strategic objectives, tax practitioners are a very important intermediary and stakeholder in the tax eco-system and are treated as such.”

SARS's full response can be viewed here.

Disclosure: CIBA distributed the survey on social media in early 2023 with an accompanying blog. CIBA is the owner of Accounting Weekly.