SARS Snapshot: Key Highlights for April 2024

SOUTH AFRICAN REVENUE SERVICES (SARS) GENERAL MATTERS

1. Trade Statistics – March 2024

In March 2024, South Africa achieved a preliminary trade balance surplus of R7.3 billion, driven by exports totalling R164.1 billion against imports of R156.8 billion. Comparing the first quarter of 2024 with the same period in 2023, we saw a significant turnaround, the surplus of R10.8 billion being a notable improvement from the previous year's R5.7 billion deficit. This positive shift highlights the dynamic trade activities that are influencing the economic landscape. For additional insights, visit the Trade Statistics webpage or read the full media release here.

2. Tax Workshops and Mobile Tax Unit Schedules

The tax workshop schedule for Bloemfontein, Upington and Western Cape during May 2024 has been published.

The Mpumalanga Mobile Tax Unit Schedule for April to June 2024 is now available.

3. Public Benefit Organisations: IT3(d) Submission Update

From May 2024, Section 18A approved Public Benefit Organisations must submit data to SARS regarding tax-deductible receipts they issued from 1 March 2023 to 29 February 2024. If an organisation did not issue any receipts during this period, it must file a NIL declaration.

Organisations need to be registered and updated on eFiling to make this process smoother. SARS offers educational resources, including micro-learning videos on its website and YouTube channel, to guide organisations through the submission process. Additional instructional videos are planned to be available soon. SARS can also be contacted at TEISegment@sars.gov.za for further assistance.

4. Be Aware of Scams

Various new scams are circulating that involve letters of demand and debit order details. DO NOT click on any links and delete these emails immediately. For examples of these scams, please visit our Scams & Phishing webpage.

5. SARS Reports Positive Revenue Results

SARS reported a preliminary revenue collection of R2.155 trillion for the 2023/24 fiscal year, achieving a record high. Established in 1997, SARS has played a key role in the nation's economy, witnessing a growth in tax revenue from R114 billion in 1994/95 to the current figures, reflecting a significant growth rate. This year, the revenue collected in just the last four business days matched the total collected in the entire year of 1995. After disbursing R414 billion in refunds, the net revenue for this year amounted to R1.741 trillion, surpassing last year’s by R54 billion and exceeding revised estimates by nearly R10 billion. For more detailed information, refer to the full media release available through SARS. Read the media release for more details.

LEGAL MATTERS

6. Supreme Court of Appeal – Following the correct dispute procedures

Lueven Metals (Pty) Ltd v Commissioner for SARS

In the case between Lueven Metals Pty Ltd and the Commissioner for the South African Revenue Service, the South African Supreme Court of Appeal upheld the decision to dismiss Lueven Metals' appeal concerning a VAT assessment. The tax authority had reclassified their gold sales to be subject to a 15% VAT, resulting in an additional R 51 million liability for Lueven Metals as the gold had previously been subjected to a manufacturing process.

The case was dismissed as tax disputes should first go through designated channels like objection and appeal procedures specified by the Tax Administration Act and utilise mechanisms like alternative dispute resolution or the tax board. Lueven Metals had bypassed these steps and directly approached the high court, which the majority found inappropriate. Therefore, the appeal was dismissed, reinforcing the need to exhaust all preliminary dispute resolution options before involving higher courts. This serves as a crucial reminder for tax practitioners to guide clients through the established tax dispute processes effectively.

7. High Court Judgments – Representation in Court

Candice-Jean Poulter v. the Commissioner for the SARS

In the case of Candice-Jean Poulter v. the Commissioner for the SARS, Candice-Jean Poulter challenged a tax court's decision that confirmed her 2018 tax assessment and ordered her to pay legal costs. The tax court had ruled without hearing from Poulter or her father, Mr. Gary van der Merwe, who was not allowed to represent her because he is not a legal practitioner.

The key legal issue addressed was whether Mr. van der Merwe, holding power of attorney, was entitled to appear on behalf of Ms. Poulter in the Tax Court. The court determined that non-lawyers are generally not permitted to represent parties in tax court appeals. The appeal was brought under section 133 of the Tax Administration Act, arguing that the tax court erred in its procedural handling by not allowing Mr. van der Merwe to represent Ms. Poulter.

The High Court found that the tax court had proceeded correctly, deciding the case based on the evidence available when Ms. Poulter did not appear. This rule allows the tax court to make decisions if a party or their authorised representative does not appear, provided that proper notice has been given. Therefore, the High Court dismissed the appeal, agreeing with the tax court’s procedural decisions and the initial assessment by SARS.Top of Form

8. High Court Judgments – royalty calculations for minerals transferred

Richards Bay Mining (Pty) Ltd v. Commissioner for the SARS

In the case of Richards Bay Mining (Pty) Ltd v. Commissioner for the SARS, the Gauteng High Court addressed a dispute over how to interpret tax and royalty calculations for mining operations. The court examined whether it had the jurisdiction to decide on the matter, especially concerning the interpretation of section 4(2) of the Mineral and Petroleum Resources Royalty Act, which relates to how royalties on unrefined minerals should be calculated.

The court concluded that it did have jurisdiction, contrary to the Commissioner’s claim that only the Tax Court should handle such issues. It found that all unrefined mineral resources transferred by Richards Bay Mining should be combined into a single calculation, applying one royalty rate, rather than calculating it on a mineral-by-mineral basis as the Commissioner had argued.

Ultimately, the court dismissed SARS’s preliminary objections and ordered that the mining company's method of aggregating resources for royalty calculations was correct. The Commissioner was also ordered to pay the legal costs of the proceedings.

9. High Court Judgments – Legality of the Seizure of Assets by SARS

Ramudzuli v. Commissioner for the SARS

In the case of Maemu Michael Ramudzuli v. Commissioner for SARS and Others, the Pretoria High Court reviewed an appeal concerning the seizure of Ramudzuli's vehicle and goods by SARS, which were allegedly intended for illegal export to Zimbabwe. The court affirmed the legality of the seizure, ruling that the evidence supported SARS' contention that the goods were destined for illegal export, thus justifying the forfeiture of Ramudzuli's vehicle used in the transport of these goods. The appeal was dismissed, and Ramudzuli was ordered to cover the costs, upholding the initial decision of the lower court.

10. High Court Judgments – Validity of SARS’s Search and Seizure Warrant

Bullion Star Pty Ltd v. Commissioner for the SARS

In the case of Bullion Star Pty Ltd v. Commissioner for the South African Revenue Service, Bullion Star contested a search and seizure warrant SARS obtained without notifying them. The company argued that SARS had neither disclosed all necessary details nor justified the need for such an extensive search and seizure based on the information they had.

The court found that the warrant was too broad, covering more items than justified by the circumstances of the investigation, and was not executed according to legal standards. As a result, the court invalidated the warrant, ordered the return of all seized items to Bullion Star, and banned SARS from using any information gathered during the search. Additionally, SARS was required to pay all legal costs related to the case.Top of Form

11. Supreme Court of Appeal – Admissibility of Evidence

Walter Eleazar Cyril and Another v. The Commissioner for the SARS

In the case of Walter Eleazar Cyril and Another v. The Commissioner for the SARS, the Supreme Court of Appeal dismissed an appeal concerning the admissibility of evidence obtained through a SARS inspection. The inspection was conducted under provisions of the Customs and Excise Act, which were later found by the Constitutional Court to be inconsistent with the Constitution. However, the Constitutional Court's decision was not retrospective, meaning it did not apply to actions taken before the decision was made.

The appellants argued that the evidence collected during the SARS inspection should not be admissible in their ongoing criminal trial because the Constitutional Court’s ruling invalidated the inspection. Despite their argument, the lower court ruled the evidence admissible, leading to an appeal. The Supreme Court of Appeal decided against the appeal, as it did not meet the necessary criteria, affirming the lower court's decision to allow the evidence.Top of Form

12. Binding General Ruling (BGR) 69 – VAT Documents for Agents managing gold refining or smelting for others

The document explains Binding General Ruling (BGR) 69, which relates to the Value-Added Tax Act of 1991. It focuses on the requirements for agents who manage gold refining or smelting for other parties. These agents are responsible for keeping detailed records and specific documents as outlined in Sections 54(2C) and (3) of the VAT Act. This requirement is essential because gold from various sources mixes during processing and loses its identity, necessitating precise VAT documentation.

The ruling details the documents agents need to collect and keep, such as zero-rated tax invoices and customs paperwork, especially for exported gold. Agents must also issue documents like a Sale of Gold Certificate to the principal depositor, listing details like the gold's value and the depositor's VAT registration number. If agents fail to maintain these records correctly, they could be responsible for paying additional taxes.

This BGR will be in effect starting April 1, 2024, until it is withdrawn, or the related laws are amended.

NEW AND UPDATED GUIDES

13. Exemption of income relating to South African ships used in international shipping (Interpretation Note 131)

The newly issued SARS Interpretation Note 131 (IN 131) clarifies the application of Section 12Q of the Income Tax Act, which grants tax exemptions to international shipping companies operating South African-registered ships.

IN 131 provides conditions under which income from international shipping, including profits from operating such ships and dividends derived from such income, are exempt from normal tax, capital gains tax, and dividends tax. It also details exemptions from withholding tax on interest related to financing these ships. The note specifies definitions critical for application, such as "South African ship," "international shipping," and "international shipping income," ensuring clarity on qualifying criteria for tax benefits, aiming to foster growth and international competitiveness in South Africa's maritime sector.

Key Conditions for Income Exemption:

International Shipping Company: The company must be a resident that operates one or more South African-registered ships.

South African Ship: Ships must be registered in South Africa according to the Ship Registration Act. This includes ships temporarily replacing those under repair or maintenance.

International Shipping: The shipping operation must involve the conveyance for compensation of passengers or goods, primarily engaged in international traffic.

International Shipping Income: The income must be derived mainly from the operation of ships engaged in international traffic as defined above.

Key Exemptions from Withholding Tax:

Interest Paid: Interest paid by an international shipping company to a foreign person is exempt from withholding tax if it's for debt used to fund the acquisition, construction, or improvement of a South African ship utilized for international shipping.

Key Exemptions from Dividends Tax:

Dividends Paid by International Shipping Companies: Dividends derived from international shipping income are exempt from dividends tax, ensuring that such dividends are taxed at a rate of 0%.

These exemptions are designed to encourage the operation and registration of ships under the South African flag, supporting the development of the country's maritime industry and enhancing its competitiveness in international shipping.

14. Deductions in respect of buildings used by hotel keepers (Interpretation Note 105)

The SARS Interpretation Note 105 (Issue 2) (IN 105) guides tax deductions available for buildings used by hotel keepers under Section 13bis of the Income Tax Act. Section 13bis provides an annual allowance on the cost of the erection of buildings or improvements to such buildings used by the taxpayer in the trade of hotel keeper. Specifically, the deduction rates vary based on when the building was erected or improved, with different rates applicable before and after 4 June 1988.

Key Conditions for Income Exemption under Section 13bis:

1. Incurrence of Costs: The taxpayer must incur costs for erecting or improving a building.

2. Use for Hotel Trade: The building must be used wholly or mainly in the trade of a hotel keeper, either by the taxpayer or, if let, by the lessee.

IN 105 defines what is meant by ‘building’, ‘cost’ and other terms which are not defined in the Income Tax Act and provides examples.

DOCUMENTS FOR COMMENT

15. Draft Interpretation Note – Income Tax Exemption: Water Services Provider

This note offers detailed guidance on interpreting the definition of "water services provider" as outlined in section 1(1). It specifically addresses how this definition applies to the exemption of income and other accruals received by qualifying water services providers from normal tax, as stipulated in section 10(1)(t)(ix).

Comments due by 7 June 2024 are to be sent to policycomments@sars.gov.za.

CUSTOMS AND EXCISE NEWS

16. Tariff Amendments

The following tariff amendments were published on 26 April 2024:

Notice R.4755 (Implementation date: 26 April 2024): New rebate provisions have been added when temporarily importing specific parts of journal roller bearings.

Notice R.4725 (Implementation date: 19 April 2024): Updated classifications have been implemented for fermented fruit beverages and mead to clarify these as end products of fermentation.

The following tariff amendments were published on 5 April 2024:

Notice R.4601 (Implementation date: 5 April 2024): Adjustments to the AfCFTA duty rates on various tariff subheadings have been made to align with the AfCFTA Agreement.

Notice R.4599: Reductions in the AfCFTA duty rates are applied retrospectively from January 31, 2024.

Notice R.4600: Tariff rates on minced anchovies have been lowered as recommended by Commission’s Report 719, effective retrospectively from March 1, 2024, when the amendment was put into place.

17. Updated facility codes in Box 30

The facility codes used in Box 30 on the Customs Clearance Declaration (CCD) have been updated to include the details of the newly approved container depots, ISS Global Forwarding South Africa (Pty) Ltd. and Allport Cargo Services (Pty) Ltd., in ORTIA Johannesburg.

UPCOMING DEADLINES

18. Annual Employer Reconciliations EMP501: 31 May 2024

PAYE annual employer reconciliations open on 1 April and closes on 31 May 2024. Guidance videos available:

19. Third Party Data Annual Submission: 31 May 2024

A reminder that the SARS Third Party Data Annual Submissions opened on 1 April 2024 and will close on 31 May 2024. Third parties must submit accurate and complete data for the entire period of 1 March 2023 – 29 February 2024.

Third Parties (banks, medical schemes, fund administrators, among others) must, by law, send data to SARS via a return.

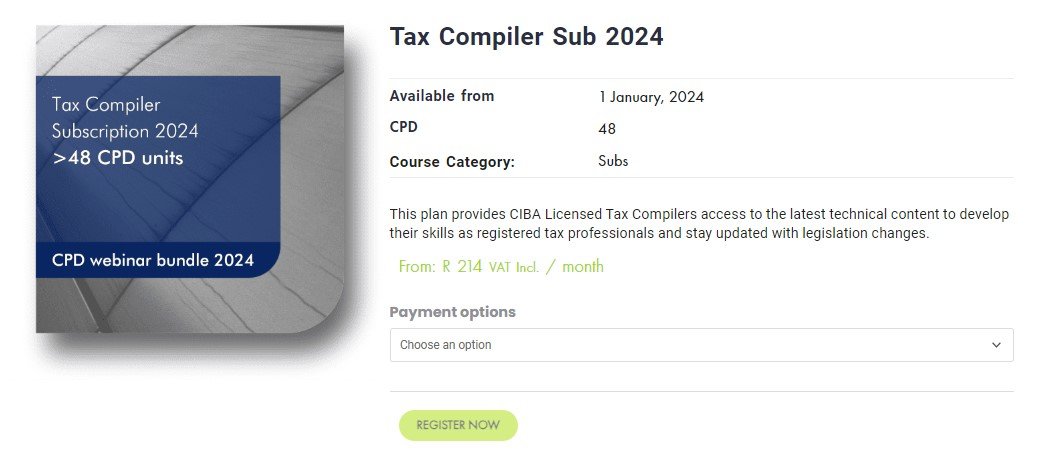

Stay current with CIBA's tax subscription offerings

If you are a CIBA tax practitioner enroll to CIBA’s Tax Compiler or Tax Advisor Subscriptions and gain access to monthly webinars covering various topics enabling you to:

Be aware of the latest legislative changes and what it means for your business, practice, and your clients;

Prepare compliant taxation returns fast;

Issue reliable taxation calculations on financial statements;

Understand the laws and regulations that govern taxation; and

Perform applicable tax compiler or advisor services.